|

NAVIGATION

|

NEWS TIPS!RightMichigan.com

Who are the NERD fund donors Mr Snyder?Tweets about "#RightMi, -YoungLibertyMI, -dennislennox,"

|

Full Coverage Insurance For Michigan TaxpayersBy Kevin Rex Heine, Section News

The more "experienced" readers of this site might recall Michigan's Great Taxpayer Revolt of 1983. In January of that year, newly-inaugurated Governor James Blanchard, who had promised in his 1982 campaign against Richard Headlee that he would not address the state's financial problems through a tax increase except as a last resort, wasted a grand total of one month sliding a 38% increase in the state's income tax through the Democrat-controlled state legislature. The resulting fifteen-target recall campaign succeeded in taking out both Phil Mastin and David Serotkin (flipping the State Senate to Republican control), triggered the political ascension of a theretofore-obscure state senator by the name of John Engler (whose 1990 gubernatorial campaign against Blanchard carried the shadow of the 1983 revolt), and so thoroughly spooked state legislators that tax increases were a very touchy subject on both sides of the aisle for the next two decades.

And then came Governor Granholm.

2004 House Bill 5632, introduced by Rep. Larry Julian (R) on March 10, 2004, was intended "to raise the state cigarette tax by 75 cents a pack ... increase taxes on other tobacco products by a proportionate amount, and use most of the money to avoid budget cuts ..." (according to Michigan Votes). Keep in mind that this was when the Michigan Republican Party had majority control in both chambers of the state legislature (63 / 110 in the State House and 22 / 38 in the State Senate); republicans had to cooperate in order for this to pass! Final passage (House Roll Call 547 on June 23rd, 2004, and Senate Roll Call 455 on June 24th, 2004), which with Governor Granholm's signature implemented Public Act 164 of 2004, had the cooperation of 13 republican representatives and 6 republican senators. Two of those state senators (Wayne Kuipers and Bill Hardiman) ran for Congress in 2010, while one (Tom George) not only thought that a gubernatorial run in 2010 was a good idea, but also was a leading "republican" advocate in favor of Proposal 10-1 (the constitutional convention question), and four of the then-representatives (Randy Richardville, Judy Emmons, Howard Walker, and Tom Casperson) now sit as state senators.

This from the legislative leadership of a state party that holds as one of its core principles the belief that "government must practice fiscal responsibility and allow individuals to keep more of the money they earn." And the party elite wonder why the tea party movement is so adamant about removing the fiscal moderates from the ranks (both elected officials and internal party leadership) by any lawful means necessary. If the party leadership would actually do a better job of enforcing a little internal discipline on those who wander off the reservation on core issues, we wouldn't have half the problems we do unifying grassroots support during an election year. We also wouldn't have half the fight that we do regarding a ballot proposal that should be a no-brainer. The Republican National Committee gets this, and in the 2012 Republican National Platform (PDF version available at this link), in the Rebuilding the Economy and Creating Jobs section, Item # 7 (Balancing the Budget) says in part:

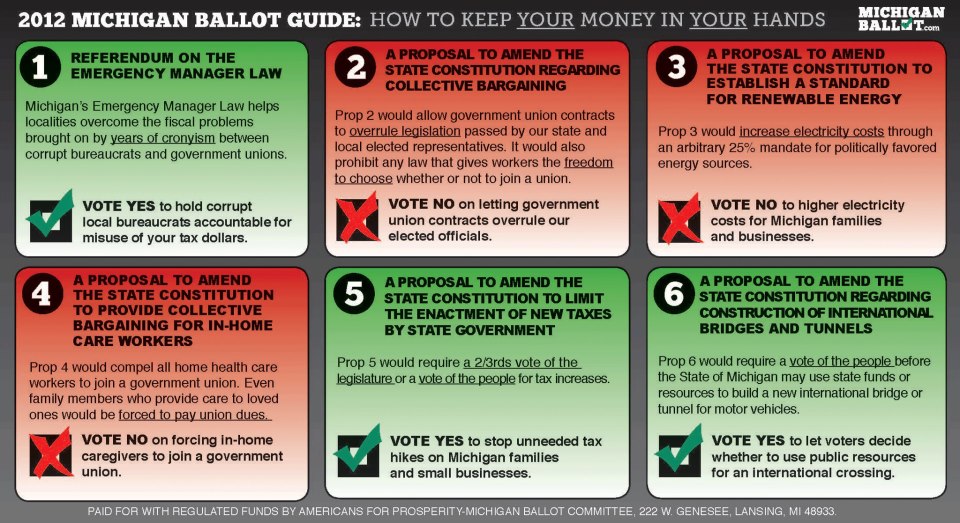

We call for a Constitutional amendment requiring a super-majority for any tax increase, with exceptions for only war and national emergencies, and imposing a cap limiting spending to the historical average percentage of GDP so that future Congresses cannot balance the budget by raising taxes. Right there in the RNC platform, everybody. Right there is the acknowledgement that the legislature cannot be trusted to not reach for their Taxpayers Express card every time they have a budget gap to address, regardless of who the majority party is. This platform item also acknowledges that major structural changes need to be made to the budget process, including passing a Balanced Budget Amendment to the U. S. Constitution. Toward that end, I believe that the RNC is supporting Senate Joint Resolution 10, specifically because it's pretty close to what the platform calls for. I happen to hold that House Joint Resolution 73 is a better option; though I cede that the 2/3 limitation for tax increases could be incorporated to make it stronger. (A short explanation of how H.J.Res73 is supposed to work can be found at this link.) You'd think that, just over one week removed from the national convention, the Michigan Republican Party in its own state convention would have placed on the floor a resolution on the question of whether or not to support Proposal 12-5 (the Michigan Tax Limitation Amendment). Getting a majority vote to authorize a resolution supporting this shouldn't have been more than procedural housekeeping; yet as Jason reported two days later, the matter was neither brought to the floor nor placed on the convention ballot for consideration. Evidently, the kleptocracy establishment in the MIGOP (both elected officials and party leadership) wasn't interested in knowing whether the delegation would support a proposed amendment that's actually in line with the party's stated core principles and the national platform. To say that it begs the question of why is something of an understatement. What I have found most disturbing over the past seven weeks is that not only the state party, but also several county parties and district leadership organizations, as well as multiple tea party leaders are content to parrot the meme being spewed by both Governor Snyder and Lieutenant Governor Calley that we should vote "yes" on 1 and "no" on everything else, because we don't want people tinkering with our state constitution (keep your stinking hands off our constitution, dammit). Which, quite frankly, I view as a bathtub-size crock of h-------t, because if taxation policy isn't supposed to be in the state constitution, then why did the authors include Article IX (Finance and Taxation)? And if we're not supposed to be amending the constitution as the need arises, then why did the authors include Article XII (Amendment and Revision)? In fact, since the current Constitution of Michigan was ratified in 1963, we have amended it four times with regard to taxation policy, each time using the amendment process to place constitutional obstacles to the legislature's natural inclination to reach for the taxpayers' checkbook every time they need to close a budget gap:

Which brings us back to the question: If the mandates and limitations on finance and taxation policy in Article IX of the Constitution of Michigan can be legitimately amended by the process outlined in Article XII, and since even the alleged "party of fiscal responsibility" has demonstrated that they cannot be trusted to leave other people's money alone, and since Michigan's proposed Tax Limitation Amendment is actually called for in the RNC 2012 National Platform, then why have so many "Taxed Enough Already" leaders, Republican Party leaders at state, district, and county levels, and nearly every in-state "conservative" media talking head come out against a very "common sense conservative" idea? Quite frankly, it reminds me of the uphill fight that the Michigan Civil Rights Initiative had in 2006. Apparently we've forgotten that the legislature cannot be trusted to not reach for their Taxpayers Express card every time they have a budget gap to address, regardless of whom the majority party is. We've also apparently forgotten that every so often, a citizen-initiated smackdown (that lasts longer than the current election cycle) is necessary in order to remind the state's political class who's actually in charge here. In this case, another citizen-initiated constitutional shackle is necessary to keep the politicians out of the citizens' wallets. Put the brakes on runaway state taxation . . . YES ON FIVE!!!

Full Coverage Insurance For Michigan Taxpayers | 4 comments (4 topical, 0 hidden)

Full Coverage Insurance For Michigan Taxpayers | 4 comments (4 topical, 0 hidden)

|

Poll

Related Links+ Michigan's Great Taxpayer Revolt of 1983+ James Blanchard + Richard Headlee + Phil Mastin + David Serotkin + John Engler + 2004 House Bill 5632 + according to Michigan Votes + House Roll Call 547 + Senate Roll Call 455 + Wayne Kuipers + Bill Hardiman + Tom George + Randy Richardville + Judy Emmons + Howard Walker + Tom Casperson + government must practice fiscal responsibility and allow individuals to keep more of the money they earn + 2012 Republican National Platform + PDF version available at this link + Rebuilding the Economy and Creating Jobs + Balancing the Budget + Senate Joint Resolution 10 + House Joint Resolution 73 + can be found at this link + Proposal 12-5 + Michigan Tax Limitation Amendment + as Jason reported two days later + Governor Snyder + Lieutenant Governor Calley + Finance and Taxation + Amendment and Revision + Proposal 1974-C + Proposal 1978-E + Proposal 1978-M + Proposal 1994-A + "Voter's Choice" Tax Amendment + Proposal 1984-C + citizen-in itiated constitutional shackle + + Also by Kevin Rex Heine |

|||||||